The journey to understanding the benefits of life insurance can feel like navigating through an intricate maze.

But imagine having a guide that unravels these complexities into simple, digestible insights.

Join us as we explore the hidden opportunities presented by life insurance and equip yourself to unlock its true potential fully!

Quick Navigation Links

Types of Life Insurance

Types of Life Insurance

Life insurance provides a safety net for your loved ones, protecting them in unexpected circumstances. It offers financial security, ensuring they are not left without support during difficult times.

When you purchase life insurance, you enter into an agreement with an insurance company that promises to pay a death benefit if something unfortunate happens.

It’s important to understand the three main types of life insurance, which are term, universal, and whole life insurance. Each kind has its variations and options to suit individual preferences and requirements.

Benefits of Term Life Insurance

Benefits of Term Life Insurance

Term life insurance is like having an umbrella for a rainy day – it offers protection, but only for a specific period.

Term insurance coverage provides substantial benefits at affordable premiums, making it a cost-effective option for many people.

The duration of the term can range from 10 to 40 years. In the event of your death, while the policy is active, your beneficiaries will receive the death benefit specified in the insurance contract.

Among the various term options available, a 10-year policy is typically the least expensive as it provides coverage for a decade before expiring.

On the other hand, 20-year and 30-year terms are pricier but offer extended coverage over longer periods.

It’s good to know that term coverage can be converted into a permanent life insurance policy.

A life insurance conversion is usually the best option for policyholders who want to extend their coverage without undergoing a new medical exam.

Benefits of Whole Life Insurance

Benefits of Whole Life Insurance

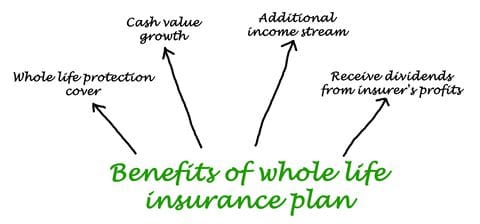

Let’s talk about whole life insurance, which is more akin to owning a home rather than renting. Unlike term insurance, it doesn’t have an expiration date as long as you continue paying the premiums.

Whole life insurance provides coverage for your entire lifetime and builds up savings in the form of cash value at a steady fixed interest rate.

Think of this cash value component as a tree that grows steadily throughout your lifetime, bearing fruit year after year.

The cash value growth in a whole life insurance policy is tax-deferred, meaning you don’t have to pay taxes on any gains until you withdraw them.

Some whole-life policies offer dividends that can increase coverage, accumulate additional cash value, reduce premiums, or be taken as cash.

This pool of savings can be tapped into through policy loans or withdrawals to meet financial needs such as paying off debts or funding education expenses.

Naturally, the added benefits of whole life insurance come with a hefty price tag that should be carefully evaluated before making this long-term commitment.

Benefits of Universal Life Insurance

Benefits of Universal Life Insurance

Universal life insurance offers lifetime coverage with the flexibility to adjust your premium payments and death benefits.

Universal life insurance also grows cash value, which you can access through a withdrawal or policy loan during your lifetime. The growth rate fluctuates with prevailing interest rates and the type of universal life you buy.

Guaranteed universal life provides the option of flexible fixed premiums and lifelong coverage with minimal cash value accumulation.

GUL policies typically have a guaranteed minimum interest rate of around 3% and an often higher current interest rate.

On the other hand, indexed universal life is pricier and focuses on increasing your cash value by linking it to various indexes, such as the Dow Jones, S&P 500, and the NASDAQ.

If your financial goals involve gradually increasing your wealth through cash value accumulation, you should consider either IUL or whole-life insurance.

However, if you’re seeking cheap lifelong protection without needing cash value savings, a GUL policy would be your best bet.

To compare the cost difference between universal vs. whole life insurance for males, please refer to the chart below.

Cost of $1,000,000 Universal vs. Whole Life

| Age | Universal | Whole |

| 20 | $211 | $640 |

| 30 | $310 | $921 |

| 40 | $464 | $1,373 |

| 50 | $711 | $2,118 |

10 Benefits of Life Insurance

Aside from offering coverage in the event of an unexpected death, life insurance has several other advantages.

By exploring the ten benefits of life insurance, you can better understand why basic coverage should be a fundamental part of your financial plan.

Mortgage Protection

Mortgage Protection

Mortgage protection life insurance is a valuable type of coverage that pays off the balance of your mortgage if you pass away.

Typically, banks offer mortgage life insurance as part of closing when you take out a new mortgage or refinance an existing one.

However, it’s important to note that mortgage protection sold by banks is much more costly than individual term life policies available in the open market.

With term life insurance, your beneficiaries will receive a payout if you die within the specified term. This money can then be used to pay off any remaining balance on the mortgage and other outstanding debts.

Income Replacement

Income Replacement

Another benefit of life insurance is that it can replace the income you would have made over your lifetime to provide for your beneficiaries when you die.

The death benefits offered can be used to cover essential expenses such as mortgage payments or educational costs, ensuring that normal day-to-day activities are not significantly disrupted due to sudden changes in income.

Additionally, these funds provide beneficiaries with financial relief, allowing them time to make crucial decisions without being negatively influenced by immediate monetary pressures.

According to the 2022 Insurance Barometer Study conducted by LIMRA, 44% of American households admit they would face financial hardship within six months if the primary wage earner were to pass away.

Term life insurance plans offer an affordable solution and are typically adequate for most couples’ coverage needs.

Transfer Wealth

Transfer Wealth

One way to utilize life insurance for transferring wealth is by purchasing a policy and naming beneficiaries. The death benefit provided by the policy can help cover estate taxes, pay off debts, or provide an inheritance to your loved ones.

Another method of using life insurance for wealth transfer is establishing an Irrevocable Life Insurance Trust.

An ILIT typically owns a survivorship life insurance policy, which pays out the death benefit only when both spouses pass away.

Upon the passing of both spouses, the death benefit is paid to the trust, which then distributes the funds according to your wishes among your chosen beneficiaries.

Since this strategy can be complex, seeking guidance from a financial advisor or estate planning attorney is essential before making any decisions.

Charitable Life Insurance

Charitable Life Insurance

Charitable life insurance involves designating a charity as the beneficiary. The policyholder pays the premiums, and the charity receives the payout upon their death.

Setting up a charitable life insurance policy is straightforward and involves no complex paperwork or legal fees.

Donating a policy can result in significant tax benefits. The donor may be eligible for a charitable deduction based on their premiums, reducing their taxable income.

Additionally, charitable life insurance allows individuals to leave behind a lasting impact by supporting causes they deeply care about.

Lastly, by donating through life insurance, individuals can make more substantial contributions than they might otherwise be able to achieve through alternative methods.

Savings Benefits of Life Insurance

Life insurance policies, such as universal and whole life insurance, provide advantageous savings benefits that can be utilized during your lifetime.

With each premium payment, you steadily accumulate a cash value sheltered from taxes. The interest rate earned on this cash value varies depending on the specific type of permanent life insurance policy you select.

The Infinite Banking System and Life Insurance Retirement Plans advocate overfunding life insurance to create a cash-rich savings account.

However, permanent coverage can be expensive and should only be considered by individuals with enough disposable income to pay their premiums consistently.

Tax Benefits of Life Insurance

Along with the savings benefits, life insurance policies have several tax advantages.

Since the cash value in permanent life insurance policies grows on a tax-deferred basis, your cash value will accumulate faster since no taxes are deducted.

The best part is that you can access the cash value whenever needed. You can withdraw or borrow against it without worrying about taxes if you take out less than the premiums you have paid.

So, are the death benefits from life insurance taxable when you die? In the unfortunate event of your passing, your beneficiaries will receive the policy’s death benefit tax-free.

Remember that if you have outstanding withdrawals or policy loans, it will reduce your death benefit if left unpaid.

Living Benefits of Life Insurance

Living Benefits of Life Insurance

Life insurance riders offer additional benefits and flexibility to standard life insurance policies. However, it’s essential to carefully consider the value of each rider before purchasing.

Some riders also fall into the category of living benefits, providing access to a portion of your death benefit during your lifetime.

For instance, a long-term care rider can help cover expenses related to in-home care or assisted living when you can no longer perform daily activities independently.

An accelerated death benefit rider allows you to use part of your death benefit for palliative care or other necessary expenses if you have been diagnosed with a terminal illness.

Some policies also offer living benefits riders designed to provide financial support in case of a critical or chronic illness.

This support system offers a one-time payment when diagnosed with an illness, which helps cover expensive treatments and alleviates financial burdens.

Relieving the stress of finances allows individuals to concentrate on fighting the disease without worrying about depleting their savings or accumulating debt.

Debt Repayment

Debt Repayment

If you have a policy that accrues cash value, you can borrow from your policy to pay off your debts. It’s like having a secret weapon to ease financial stress!

However, knowing the details when borrowing against your policy is important. Remember that interest will accumulate on the loan, so it’s wise to repay it as soon as possible.

Additionally, in the event of your passing, your life insurance can provide relief by covering any remaining debts. This offers peace of mind for you and your loved ones, ensuring that no one will be burdened with your financial responsibilities.

This approach allows beneficiaries to avoid accruing interest on the outstanding debt, resulting in long-term savings.

By utilizing life insurance to pay off debts, beneficiaries can also allocate more funds towards saving and investing.

Final Expense Life Insurance

Final expense coverage is available with universal life and more expensive whole-life insurance policies.

It helps seniors cover end-of-life expenses so their beneficiaries will not have to dip into their savings or use credit.

Once you purchase this coverage, the premiums will remain fixed for your lifetime. Additionally, the death benefits provided by final expense life insurance will never decrease in value.

Final expense coverage is typically the most suitable option for seniors over 70 who have not saved enough money to cover their final expenses.

Emotional Security

All the benefits of having life insurance alleviate worry, allowing you to sleep better at night and knowing that your family will be financially secure.

By selecting an appropriate policy, you can safeguard against mortgage payments, secure funds for your children’s education, or replace lost income if you were the primary provider for your family.

In essence, life insurance allows families to concentrate on healing and cherishing the memories of their departed family members without the added stress of financial concerns.

Do You Need Life Insurance Quotes?

- Select Duration

- Select Amount

- Press Get Quote

We have navigated the complex world of life insurance together. Armed with this knowledge, you can make informed decisions illuminating your path toward a secure future.

If you need more help choosing a life insurance policy, we invite you to contact us today.

Our insurance experts are here to provide all the information and guidance needed to find a comprehensive plan that fits your situation and goals.

FAQ: 5 Benefits of Life Insurance

FAQ: 5 Benefits of Life Insurance

How much life insurance is enough for most families? The appropriate amount of coverage depends on your income, debts, and dependents. Your coverage is suggested to be between 7-10 times your annual income. Yet, the specific amount required will depend on your particular requirements.

What are the top 5 benefits of life insurance? Life insurance provides tax-free benefits upon death, potential savings opportunities, advantageous tax treatment, the ability to borrow against the policy’s value, and potential dividends.

Which type of life insurance provides living benefits? Living benefits are added as riders on specific term and permanent life insurance policies. They provide monetary assistance while living in the event of a terminal illness diagnosis, chronic illness, or the need for long-term care.

What are the benefits of life insurance for retirees? Life insurance offers numerous advantages for retirees. It provides valuable support to cover expenses arising after your passing, such as final costs, outstanding debts, and taxes. Without sufficient income from other sources, your beneficiaries could face financial strain in meeting these obligations.

Trending Life Insurance Topics

-

Affordable Life USA offers comprehensive life insurance solutions to families and business owners throughout the United States.

Our founder, Eric Van Haaften, developed his passion for quantitative analysis while earning his business degree from Ferris State University, which laid a strong foundation for his analytical approach to financial planning.

Eric has obtained a professional LUTCF designation, awarded by the National Association of Insurance and Financial Advisors and the American College of Financial Services.

Another professional accolade is qualifying for the prestigious Million Dollar Round Table. Eric also serves as the treasurer of the Senior Sing Along charity.

Eric Van Haaften, LUTCF

-

Affordable Life USA

2524 Woodmeadow Grand Rapids, MI 49546 . 1-877-249-1358

Types of Life Insurance

Types of Life Insurance Benefits of Term Life Insurance

Benefits of Term Life Insurance Benefits of Whole Life Insurance

Benefits of Whole Life Insurance Benefits of Universal Life Insurance

Benefits of Universal Life Insurance

Mortgage Protection

Mortgage Protection Income Replacement

Income Replacement Charitable Life Insurance

Charitable Life Insurance

Living Benefits of Life Insurance

Living Benefits of Life Insurance Debt Repayment

Debt Repayment

FAQ: 5 Benefits of Life Insurance

FAQ: 5 Benefits of Life Insurance