Are you trying to determine what life insurance dividends are and whether they can benefit your family financially? If so, then you’ve come to the right place.

We will explore life insurance dividends, and how they work, and cover some key features for critical decision-making when selecting coverage for your family.

Our guide will give you the information needed to make an informed decision.

quick link navigation

What are Life Insurance Dividends?

Permanent coverage has a lifetime death benefit and a cash value component that can act as an investment vehicle.

There are several types of permanent life insurance, including guaranteed universal, indexed universal, variable universal, and whole life insurance.

However, only whole-life policies provide additional long-term benefits in the form of dividend payments.

Mutual vs. stock Insurance Company Dividends EXPLAINED

Mutual vs. stock Insurance Company Dividends EXPLAINED

The two kinds of insurance companies that offer dividend-paying policies are classified as mutual or stock owned.

Why are dividends from a mutual insurer different from a stock-owned insurance company?

The policyholders actually own mutual companies, and dividends are paid annually when profits exceed claims and operating costs.

The amount of your dividend is not guaranteed and can vary depending on your insurance company’s financial performance during the year.

With stock insurers, if the stock price rises, a dividend is declared, and participating policyholders share in the profits.

When the company’s stock falls, policyholders do not lose money, but they may not receive a dividend that year.

Dividends are most common among mutual insurers, as stock-owned companies pay dividends to their shareholders instead of policyholders.

Stock companies that pay dividends are often not as competitive as the whole life offered by mutual companies.

Dividend Paying Whole Life Insurance

Dividend Paying Whole Life Insurance

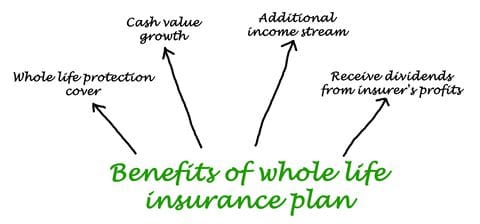

Whole life insurance is the most popular form of permanent coverage because of its contractual guarantees and dividend potential.

There are various types of whole life insurance policies available, so it’s necessary to understand the differences before deciding which one is right for you.

People interested in investment-style policies should always buy a more expensive participating policy from a mutual insurance company.

While those interested in death benefits should buy non-participating policies that do not pay dividends and consequently offer lower premiums.

How are whole life insurance dividends calculated?

How are whole life insurance dividends calculated?

Life insurance companies use dividend scales to calculate the annual dividends that you will receive each year.

Dividend scales consider mortality experience, expenses, and investment earnings.

When you pay a premium, a portion is put into the company’s reserve account to cover their claims and operating expenses.

The reserve account is called a divisible surplus which is invested in very liquid conservative assets.

Each year, your insurer will calculate the portion of its surplus to set aside to be distributed to participating policyholders as dividends.

Annual dividends are not guaranteed because a company cannot foresee what divisible surplus will be available each year.

This ultimately depends on how your insurance company manages its mortality risk, expenses, and investments.

- Mortality: The mortality risk is calculated on the death claims paid compared with your insurer’s estimates while underwriting policies.

- Expenses: Companies have administration costs and salaries. The expense portion of your dividend reflects the difference between the actual expenses incurred during the year and projected expenses.

- Investments: Investment performance is another component in determining your dividend. Favorable investment results can positively affect dividends, while low returns may require subsidizing from the surplus.

How Does Cash Value Influence Dividends?

How Does Cash Value Influence Dividends?

Your insurance company’s dividend scale can considerably impact the future value of a life insurance policy.

Since your dividend is usually calculated as a percentage of your current cash value, policyholders who receive more dividends will have more cash value over time.

Here is an example of how cash value can affect your dividend payout. If your present cash value is $100,000 and your dividend yield is 5%, your payout would be $5,000.

Plus, when you consistently reinvest your dividends back into the cash value, your distributions really accelerate!

Dividend Options for Life Insurance

Dividend Options for Life Insurance

Dividends can be a great way to unlock the potential of your life insurance policy and make it work for you.

Whether you’re purchasing or have already invested in a policy, you should consider several critical features related to dividend payouts when considering what option best fits your needs and goals.

- Cash: A life insurance dividend check can be mailed directly to you. This option is best for people wishing to reinvest the funds in investments that could earn more income.

- Premium Deduction: The reduction of premium option uses the dividend to reduce your future premiums owed to offset the cost.

- Loan Reduction: If you have an outstanding policy loan, you can direct your insurer to apply dividends toward repaying the loan.

- Paid-up Additions: This dividend option will increase the death benefit of your existing policy. The paid-up insurance amount also earns extra dividends and builds a tax-deferred cash value.

- Accumulate At Interest: Insurance policy dividends can be held with the company and will earn an interest rate set by your insurer. These dividends can be withdrawn anytime without affecting policy performance. The interest earned on policy dividends is taxable in the year credited.

Do You Need Life Insurance Quotes?

Do You Need Life Insurance Quotes?

- Select Lifetime

- Select Amount

- Press Get Quote

How Are Life Insurance Dividends Taxed

How Are Life Insurance Dividends Taxed

If you own or are considering purchasing a life insurance policy, it’s essential to understand the tax implications around dividends and other distributions of cash value.

Many people don’t realize that life insurance policies generate earnings over time and may be subject to taxes depending on how the money is used or withdrawn.

Because dividends are considered a return of the premiums that you have paid, the IRS gives preferential tax treatment to dividend distributions.

So, dividends paid from a life insurance policy are nontaxable when paid to you in cash, used to reduce your payments, used to repay policy loans, or utilized to buy paid-up additions.

If dividends are left to accumulate with your insurer, only the interest earned on policy dividends will be taxable.

Insurance dividends grow tax-deferred if you reinvest them into your policy’s cash value.

You will owe taxes on the policy’s tax-deferred growth if you cancel your policy, decide to sell the policy, or if it becomes a modified endowment contract.

You could also owe taxes if your dividends exceed the total amount of premiums you’ve paid or if you withdraw cash value beyond your total payments.

The good news is that life insurance loans are tax-free regardless of premiums paid, dividends acquired, or interest earned.

These tax advantages make dividend-paying life insurance a solid investment because you can take out most of your premiums and still maintain coverage.

Choosing the Best Dividend Option

Choosing the Best Dividend Option

Finding the best life insurance dividend strategy for your needs can seem challenging.

But, with the proper guidance, you can make life insurance work for you as a reliable income-producing asset while still protecting your beneficiaries in case of death.

As you assess options during your lifetime, learning more about the available dividend options and their implications on your finances is essential.

You can always modify your dividend election yearly, but many policyholders use the following dividend strategies.

Dividends During Your Accumulation Years

Dividends During Your Accumulation Years

PUAs or paid-up insurance refer to tiny additions in the death benefit to an existing insurance policy that do not require additional payments.

Paid-up additions are purchased with dividends, add to the value of your original coverage, and increase the cash value over time.

We recommend purchasing paid-up additions because as you acquire more PUAs, your cash value and death benefit increase.

Consequently, you become eligible for additional dividends as your death benefit increases.

Many investment-minded people also purchase paid-up additions riders (PUAR) to enhance the policy’s cash value and death benefit.

Dividends During Retirement

Dividends During Retirement

Once you are retired, many people change future dividends to be paid in cash to create a predictable income stream.

Taking dividends in cash does not reduce your death benefit or your guaranteed cash value accumulation.

If you want even more income, you can also surrender paid-up additions which will reduce your death benefit.

Once you have taken out cash equal to the amount you have put into your policy, you should take a policy loan against what cash value is left in your policy to avoid taxation.

Look for companies offering non-direct recognition policies that still credit you the same dividend even when you have borrowed from your policy.

So long as a small death benefit remains when you die, no income tax is charged on any prior withdrawals and loans.

Dividends To create an inheritance

Dividends To create an inheritance

You can change your dividend election to purchasing paid-up insurance to maximize the death benefit for beneficiaries at any time.

This can be a good decision if you develop a health condition, no longer need income, or want to leave a legacy for your family.

The death benefit on your whole life policy will forever be greater than the cash value you can spend while alive.

⊕

If you need a high-cash-value, low-commission dividend-paying whole-life policy, we can find one that accumulates savings quickly.

People only needing permanent coverage for death benefit protection should buy a cheaper guaranteed universal life policy instead.

No matter what you decide, we are here to help you every step of the way.

Give us a call or get started with some permanent life insurance quotes using our life insurance calculator.

Best Dividend-Paying Insurance Companies

Best Dividend-Paying Insurance Companies

Many buyers consider whole life insurance an investment because of its guaranteed cash-value accumulation and dividend options.

Which whole life insurance carriers pay consistent dividends?

Several fantastic mutual companies like Northwestern Mutual, New York Life, MassMutual, and Penn Mutal offer participating policies that pay dividends.

Northwestern Mutual and New York Life are captive insurance companies, so their agents can only sell their policies compared to an independent broker representing many insurance carriers.

Companies like MassMutual and Penn Mutual are committed to marketing through independent agents if you have a few medical issues or want more options.

The best dividend-paying whole-life companies naturally have excellent financial ratings from the four major rating agencies A.M. Best, Fitch Ratings, S&P Global Ratings, and Moody’s.

Affordable Life USA is a nationally licensed agency that monitors a network of many of America’s highest-rated insurance companies.

The top two companies for dividend yield in 2022 were MassMutual at 6.0% and Penn Mutual, which had a dividend of 5.75%

spotlight on Penn Mutual

spotlight on Penn Mutual

Penn Mutual is our choice for somebody looking for a whole-life policy with dividends or a significant death benefit.

Plus, Penn Mutual offers policies for up to $7,500,000 death benefit without a medical examination.

Their Guaranteed Choice whole-life product offers many payment options, from limited pay (10 and 20 years) to longer pay products paid up at age 65 or 100.

Penn Mutual is among the best-performing whole life insurance policies because of its cash value performance and industry-leading dividend rate.

To maximize Penn Mutual’s performance, you want to ask us about overfunding your policy with the infinite banking system.

Trending Life Insurance Topics

-

Affordable Life USA offers comprehensive life insurance solutions to families and business owners throughout the United States.

Our founder, Eric Van Haaften, developed his passion for quantitative analysis while earning his business degree from Ferris State University, which laid a strong foundation for his analytical approach to financial planning.

Eric has obtained a professional LUTCF designation, awarded by the National Association of Insurance and Financial Advisors and the American College of Financial Services.

Another professional accolade is qualifying for the prestigious Million Dollar Round Table. Eric also serves as the treasurer of the Senior Sing Along charity.

Eric Van Haaften, LUTCF

-

Affordable Life USA

2524 Woodmeadow Grand Rapids, MI 49546 . 1-877-249-1358

Mutual vs. stock Insurance Company Dividends EXPLAINED

Mutual vs. stock Insurance Company Dividends EXPLAINED Dividend Paying Whole Life Insurance

Dividend Paying Whole Life Insurance How are whole life insurance dividends calculated?

How are whole life insurance dividends calculated? How Does Cash Value Influence Dividends?

How Does Cash Value Influence Dividends? Dividend Options for Life Insurance

Dividend Options for Life Insurance Do You Need Life Insurance Quotes?

Do You Need Life Insurance Quotes? How Are Life Insurance Dividends Taxed

How Are Life Insurance Dividends Taxed Choosing the Best Dividend Option

Choosing the Best Dividend Option Dividends During Your Accumulation Years

Dividends During Your Accumulation Years Dividends During Retirement

Dividends During Retirement Dividends To create an inheritance

Dividends To create an inheritance Best Dividend-Paying Insurance Companies

Best Dividend-Paying Insurance Companies spotlight on Penn Mutual

spotlight on Penn Mutual