If you’re wondering why affluent individuals often choose to invest in life insurance retirement plans, you’ve come to the right place.

Life insurance can be utilized alongside other investments for a well-rounded retirement strategy.

Although not the same as 401Ks, IRAs, or Roth IRAs, many wealthy individuals have found value in purchasing these policies.

LIRP insurance offers numerous benefits and drawbacks that we will explore further in this informative piece.

quick navigation links

- What is a life insurance retirement plan?

- How can a whole-life policy help you save for retirement?

- Is IUL the best life insurance retirement policy?

- Is LIRP a good investment?

- What are the LIRP insurance pros and cons?

- How can you invest in a life insurance retirement policy?

- How do you compare different retirement accounts?

- FAQs: Life Insurance Retirement Plans.

What is a Life Insurance Retirement Plan?

What is a Life Insurance Retirement Plan?

What is the LIRP meaning anyway? LIRP, or Life Insurance Retirement Plan, is a retirement strategy in which the cash value of permanent life insurance policies is utilized to house retirement assets.

LIRP insurance allows for tax-deferred growth of cash value within the policy. You can accumulate abundant cash values in these life insurance savings plans by overfunding contributions.

The main objective of LIRP is to maximize your cash value rather than focusing on buying a large death benefit. This allows you to access the accumulated funds through tax-free policy loans.

With proper planning and funding, a LIRP can provide financial security in retirement while also protecting loved ones with its life insurance component.

How Do Cash Values Perform?

Depending on the type of permanent coverage you buy, your cash values earn interest at a guaranteed or variable interest rate.

- Whole Life Insurance: Your cash value is guaranteed, while dividends can fluctuate.

- Indexed Universal Life: Cash values earn interest rates that are linked to the performance of an underlying financial index such as the S&P 500.

- Variable Universal Life: The interest paid in a variable policy is based upon the performance of the mutual fund sub-accounts inside the policy.

Each type of life insurance has various risk-reward trade-offs and should be selected based on your risk tolerance, much like conventional investments.

Policies with the potential to generate better cash values generally have higher performance uncertainty, as the returns could be more significant or more detrimental than initially projected.

The two safest products for most LIRPs will be either dividend-paying whole-life or indexed-universal life insurance.

How Do LIRP Loans Work?

How Do LIRP Loans Work?

One of the main advantages of having a LIRP is the ability to access cash value through withdrawals and loans.

Withdrawals are tax-free up to the amount you have paid into the policy, but any excess will be subject to taxation.

Policy loans allow you to borrow from your cash value and use it as supplemental retirement income. The flexibility of these loans is a major benefit.

Unlike traditional bank loans, policy loans have no strict repayment schedule. You can choose when and how much you want to repay, giving you more control over your finances.

Be careful with an aggressive loan strategy. The policy may lapse unless additional premiums are contributed if your cash value drops below a certain threshold due to outstanding loans.

It’s important to note that these policy loans remain tax-free if the policy doesn’t lapse, become an MEC, and coverage stays active until your death.

If you die with an outstanding loan balance, it will reduce your death benefit.

LIRP With Whole Life

LIRP With Whole Life

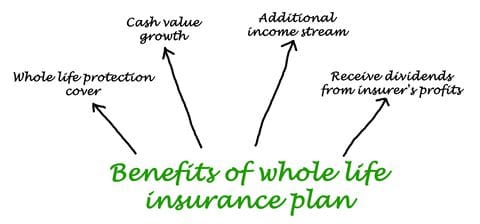

People looking for safety and predictability should consider whole-life insurance as a retirement plan.

Individuals interested in investment-style policies should always purchase a more expensive participating whole-life policy from a mutual insurance company.

Mutual insurers will outperform the competition because their whole-life policies offer dividends that can positively affect performance over time.

We suggest purchasing paid-up additions with your dividends that add to the value of your original coverage and increase the cash value over time.

Penn Mutual offers flexible payment options for funding LIRP investments over four, seven, or ten years and longer durations that are paid up at age 65.

Penn Mutual was voted Investopedia’s best whole life insurance company, with industry-leading dividend rates.

We would happily integrate the best dividend-paying whole life insurance policy into your other wealth-building endeavors.

LIRP With Indexed Universal Life

LIRP With Indexed Universal Life

Indexed universal life invests your cash value into fixed or various indexes, such as the Dow Jones, S&P 500, and the NASDAQ.

These policies contain specific provisions that determine how the cash value of an IUL insurance policy is credited with interest. Participation rates and cap rates are two essential factors in these policies.

Participation rates indicate the percentage of the index’s gain that will be added to the policy’s cash value. For example, a 100% participation rate means if the index increases by 9%, the policy’s cash value will also increase by 9%.

Cap rates establish a maximum limit on the interest rate that can be applied to the policy’s cash value. If the cap rate is set at 10% and the index rises by 18%, only a 10% gain will be credited to the policy.

Another advantage of IUL policies is their ability to provide a safety net by safeguarding against market losses. When the market index declines, your cash value will not suffer any losses but instead receive a 0% return.

When evaluating IUL companies for LIPR insurance, it is beneficial to consider those offering higher participation and cap rates, as they may result in greater cash value accumulation over time.

Some top-rated companies for LIPR insurance include Mutual of Omaha, Penn Mutual, Lincoln Financial, and Pacific Life.

CNBC has recognized Pacific Life as one of America’s best life insurance providers, ranking their universal portfolio as number one!

Life Insurance for Retirement Planning

Life Insurance for Retirement Planning

Wealthy individuals favor LIRP investments as a tax-efficient strategy that combines life insurance and retirement income.

According to Success, many wealthy individuals have usually already optimized their other retirement plans and are looking for security against potential market declines in the future.

1. Already Maximizing Your Retirement Accounts

According to Forbes Advisor, you should first max out your 401(k)s and IRAs before funding a LIRP because employers often match your contribution to a specific limit.

IRA contributions are limited to $7,000 per year for those under the age of 49 and $8,000 per year for people above 50 for 2024.

Meanwhile, the IRS limits individual contributions to an employer-sponsored 401(k) at $23,000 annually for 2024.

Consequently, the highest amount somebody can contribute to an IRA and a 401(k) is $25,500 annually.

2. High Income or Net Worth

2. High Income or Net Worth

An investor will require a significant disposable income to fund a limited-pay life insurance policy appropriately.

The perfect applicant for a LIRP should be younger and earn between $150,000 and $200,000 annually.

You can effectively structure your life insurance asset to guard against untimely death and provide tax-efficient wealth accumulation.

The primary living benefit of permanent life insurance is that cash values can be obtained via policy loans and withdrawals up to the policy’s cost basis during retirement.

This tax-free loan strategy can really benefit high-income earners who wind up in higher tax brackets and spend more on taxes yearly.

So, if you have already maxed out your other tax-advantaged retirement savings plans, LIRPs can be an additional source of income in retirement.

High-net-worth people benefit from this strategy because the contribution limits for 401(k)s and IRAs are often insufficient to meet their retirement goals.

They can allocate unlimited funds to a life insurance retirement plan because there are no maximum contribution limits.

3. Many Years Until Retirement

You may prefer an investment strategy that offers better yields with fewer costs if you are close to retirement age.

An investor’s timeline can also determine whether an insurance retirement plan is a suitable investment strategy.

LIRP life insurance takes many years to reach its peak efficiency! So, most insurance retirement plan candidates are typically between 25 and 50 years old.

In the earliest years of a policy, there is no mystery that a universal life insurance contract costs more than alternative investments.

However, once the policy reaches its crossover period between the first 15 and 20 years, it can offer highly efficient tax-free income.

We can help you decide whether this dual-function life insurance policy might benefit you.

We can run illustrations to calculate a proposed policy’s charges and rate of return over time.

Compare LIRP Insurance Rates

- Select Lifetime

- Select Amount

- Press Get Quote

Is LIRP a Good Investment?

In some circumstances, insurance retirement plans can offer additional versatility, but investing in cash-value life insurance for retirement is not justified for everyone.

Let’s look at the retirement life insurance plans’ pros and cons!

ADVANTAGES OF RETIREMENT LIFE INSURANCE PLANS

ADVANTAGES OF RETIREMENT LIFE INSURANCE PLANS

- Tax-Free Death Benefit: LIRP insurance offers your beneficiaries a guaranteed tax-free death benefit with a safety net.

- Tax Hedging: As taxes unavoidably rise, you will never be taxed on a life insurance policy loan or withdrawals up to your basis.

- No Contribution Limit: Wealthy investors have no limit to the amount contributed towards retirement life insurance plans.

- Ease Of Access: The cash value can be accessed at any age, making it a vital tool for anyone planning an early retirement.

- Safety: Cash values are relatively secure compared to other investments, which is helpful when using life insurance for retirement income.

- Long-term Care: Optional LTC riders can be added to your policy and help protect your family from liquidating other assets to pay for nursing care,

- Accelerated Death Benefit: Many policies also provide an accelerated death benefit if you become terminally ill.

the disadvantages of lirp INsurance

- Needs: Avoid permanent coverage if you do not need life insurance when you retire.

- Long-Term Investment: Buying a term policy and investing the savings from not buying LIRP insurance is best for those with a short investment time horizon.

- Age Limitations: The accumulation timeline restraints of cash value life insurance make it an unsuitable investment strategy for older investors.

- Investment Options: Some cash value policies have limited investment options than dedicated retirement options such as a 401(k) or IRA.

- Expensive Premiums: The cost that can be difficult to maintain long-term is usually only advantageous for high-income and high-net-worth investors.

- Loan Treatment: Cash value loans accumulate interest until repayment and will be subtracted from your death benefit when you pass away.

- Deductibility: The contributions towards life insurance are not tax-deductible like other retirement accounts.

LIRP Insurance vs. 401(k)and IRAs

LIRP Insurance vs. 401(k)and IRAs

When it comes to retirement planning, several options are available, including life insurance retirement plans (LIRPs), individual retirement accounts (IRAs), and 401(k)s.

While all three options can be used to save for retirement, they each have their own advantages and disadvantages.

⊕

401(k) Retirement plans and IRAs

Both IRAs and 401(k)s offer tax benefits that can help grow your savings faster. Contributions made to these accounts are often tax-deductible, meaning you don’t have to pay taxes on that money until you withdraw it during retirement.

Additionally, any earnings or growth within the account is tax-deferred, allowing your investments to compound over time without being taxed annually.

An IRA is an individual account you set up with a financial institution of your choice, while employers typically offer a 401(k) as part of their employee benefits package.

One advantage of a 401(k) is employer matching contributions, where your employer matches a portion of your contributions into the account. This essentially gives you free money towards your retirement savings.

However, both IRAs and 401(k)s come with certain limitations and penalties. Annual contribution limits restrict how much you can contribute each year to these accounts. Early withdrawals before reaching age 59½ may also result in penalties.

⊕

life insurance retirement plans

LIRPs combine permanent life insurance coverage with a cash value component that grows over time.

The cash value can be utilized as income during retirement without being subject to taxes upon withdrawal (similar to a Roth IRA).

How much can you put into a Lirp? LIRPs, unlike IRAs and 401(k)s, do not have any annual contribution limits.

This makes them a great option for individuals with high incomes who wish to save more for retirement than what traditional retirement accounts permit.

Furthermore, unlike traditional IRAs or 401(k)s, which require individuals to start taking taxable RMDs by age 73, LIRPs provide the flexibility to keep funds invested for as long as desired without mandatory withdrawals in retirement.

Purchasing LIRP Insurance

Purchasing LIRP Insurance

Many successful people earn incredible money in their early 30s and 40s, and we help affluent people purchase permanent coverage during these peak earning years.

Our committed life insurance agents can help you find the most desirable coverage based on your needs, financial situation, and the risk you want to assume.

We aim to match you with the best insurance company for accumulating significant tax-deferred savings in your policy’s cash value account.

⊕

WHAT DOES A retirement LIFE INSURANCE PLAN COST?

There certainly is no established price for anyone considering a LIRP investment policy.

Using life insurance as a retirement plan can easily double the annual cost of a conventional universal or whole life policy because it serves a different purpose than straight life insurance.

You will invest a set amount of money every year, most of which you will recoup in tax-free retirement income, with the remaining death benefit going to your beneficiary.

⊕

How do you qualify for Lirp Insurance coverage?

At Affordable Life USA, we understand that time is precious for our customers. That’s why we offer two convenient programs to expedite the application process.

If you’re too busy or prefer not to undergo a medical exam, we can assist you in finding the best no-exam life insurance company. These companies often streamline underwriting by conducting a phone evaluation.

However, there are times when applying for life insurance through a brief medical exam may be more beneficial.

By opting for fully underwritten policies with multiple companies, you increase your chances of qualifying for coverage and potentially securing better rates.

⊕

HOW DO I SET UP MY LIFE INSURANCE RETIREMENT PLAN?

Many agents are not familiar with properly structuring life insurance as a retirement plan, which could leave you with a policy that does not accumulate cash value efficiently for retirement.

We work with the nation’s best insurance companies specializing in LIRPs and can customize the best policy for your budget and retirement goals.

To further assist you in making an informed decision about which policy suits your needs best, we can provide a cash value chart illustrating future projections for any policy option you consider.

Feel free to contact our office or fill out our cash value calculator form for a complimentary customized illustration.

Compare Rates with Our LIRP Calculator

- Select Lifetime

- Select Amount

- Press Get Quote

FAQs: Life Insurance Retirement Plans

FAQs: Life Insurance Retirement Plans

Is life insurance a good retirement plan? While life insurance savings plans can be a viable retirement option for the affluent, they may not be practical for regular investors due to their high costs.

Trending in Life Insurance and Retirement

-

Affordable Life USA offers comprehensive life insurance solutions to families and business owners throughout the United States.

Our founder, Eric Van Haaften, developed his passion for quantitative analysis while earning his business degree from Ferris State University, which laid a strong foundation for his analytical approach to financial planning.

Eric has obtained a professional LUTCF designation, awarded by the National Association of Insurance and Financial Advisors and the American College of Financial Services.

Another professional accolade is qualifying for the prestigious Million Dollar Round Table. Eric also serves as the treasurer of the Senior Sing Along charity.

Eric Van Haaften, LUTCF

-

Affordable Life USA

2524 Woodmeadow Grand Rapids, MI 49546 . 1-877-249-1358

What is a Life Insurance Retirement Plan?

What is a Life Insurance Retirement Plan? How Do LIRP Loans Work?

How Do LIRP Loans Work? LIRP With Whole Life

LIRP With Whole Life LIRP With Indexed Universal Life

LIRP With Indexed Universal Life  Life Insurance for Retirement Planning

Life Insurance for Retirement Planning

ADVANTAGES OF RETIREMENT LIFE INSURANCE PLANS

ADVANTAGES OF RETIREMENT LIFE INSURANCE PLANS LIRP Insurance vs. 401(k)and IRAs

LIRP Insurance vs. 401(k)and IRAs Purchasing LIRP Insurance

Purchasing LIRP Insurance FAQs: Life Insurance Retirement Plans

FAQs: Life Insurance Retirement Plans