You’re here because you’re considering buying whole life insurance and need to know the basics. That’s great!

Whole life insurance is the most popular form of permanent life insurance in America for a good reason.

If you’re wondering whether or not permanent coverage is right for you, keep reading to learn more about the pros and cons of whole life insurance.

quick navigation links

What Is Whole Life Insurance?

What Is Whole Life Insurance?

When investing in life insurance coverage, you should carefully weigh your needs and budget.

There are two primary types of life insurance for you to consider in your search for coverage, Term Life Insurance and Permanent Life Insurance.

Whole life insurance explained

As the name suggests, whole life insurance is a type of permanent coverage that protects you for your entire life. It’s different from term life, which only lasts for several years.

Whole-life policies typically have higher premiums because they offer tax-free cash values and dividends that accumulate over time.

Life insurance savings plans can be a fantastic way to save for long-term financial goals.You can withdraw or borrow against your policy’s cash value if you need cash for an emergency or additional income in retirement.

However, if you die with an outstanding loan, the amount you owe will be subtracted from your beneficiaries’ death benefit.

Whole life insurance vs. term

What is the difference between term and whole life insurance?

A term life insurance plan offers guaranteed death benefits and level premiums for between 10 and 40 years.

Term life insurance is significantly cheaper than whole life for buyers with a limited budget and significant protection needs.

Term life insurance is better suited for people only concerned about protecting a long-term mortgage or their income for surviving family members.

Whole life insurance is a wise investment for younger wealthy adults because it will take many years to accumulate cash value savings.

Whole life insurance is predominantly purchased by people looking for lifetime coverage but is more expensive than guaranteed universal life.

WHOLE LIFE VS. UNIVERSAL LIFE

WHOLE LIFE VS. UNIVERSAL LIFE

Like whole life, universal life coverage offers tax-deferred savings and lifetime coverage.

Most stock-owned companies offer a competitor to a whole life coverage that is very popular with younger buyers called indexed universal life insurance.

Indexed universal life policies allow you to allocate your cash value to a fixed account or various indexes such as the Dow Jones, S&P 500, and the NASDAQ.

For seniors needing affordable death benefits only, guaranteed universal life offers lifetime coverage at a much lower price than traditional whole life.

Whole Life Insurance Calculator

Whole Life Insurance Calculator

- Select Lifetime

- Select Amount

- Press Get Quote

Pros and Cons of Whole Life Insurance

Pros and Cons of Whole Life Insurance

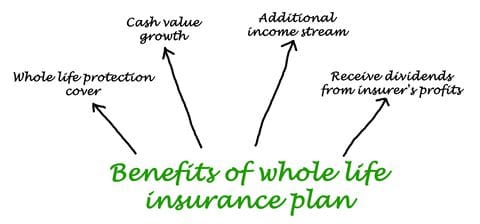

Although whole life is expensive and not for everyone, it can be a powerful savings tool if appropriately funded.

People with disposable income often diversify their investments by purchasing whole life insurance as an asset to produce additional retirement savings.

You may prefer a mutual fund investment strategy that offers better yields with fewer costs if you are near retirement age.

However, many seniors purchase coverage only for final expenses and estate conservation because of the lifetime guarantees offered by whole life.

Advantages Of Whole Life Insurance

- Permanent Coverage – Whole life coverage will last your entire life if you continue to pay your premiums.

- Tax-free Death Benefit – The death benefit that goes to your beneficiary when you die is not taxable.

- Living Benefits – Whole life offers living benefits riders that give access to a portion of your death benefit in advance if you are diagnosed as terminally ill.

- Long-term Care – A long-term care rider can be added to your policy to help you pay for long-term nursing care.

- Tax-deferred Growth – The cash value account can offer a conservative 5%-6% interest rate.

- Tax-free Policy Loans – You can borrow against your policy’s cash value. Your policy loan can be paid back or subtracted from your death benefit.

Dividends – Whole life plans pay dividends that generally are not subject to income taxation.

Disadvantages Of Whole Life Insurance

- Smaller death benefit – Whole life is more expensive than term insurance, so you can only buy a smaller death benefit with the same premium.

- Higher cost – Permanent coverage is more expensive because part of your premiums goes into a cash-value account.

- Fees & Expenses – Another downside of whole life is the initial fees and expenses that make it difficult to get ahead in the early years of your policy.

- Lack of Investment Control – The insurer invests your premiums conservatively, not appealing to experienced investors.

- Insurer Keeps the Cash Value – Unless money is taken out before you die, beneficiaries only receive your death benefit and do not get your cash value.

⊕

Buyer Tip:

First, purchase a death benefit covering your family’s life insurance protection needs.

Next, maximize your 401(k)s because employers often match your contribution to a specific limit.

Once you have already maxed out your other tax-advantaged retirement savings plans, start overfunding your current whole life for additional retirement savings.

Types Of Whole Life Insurance

Types Of Whole Life Insurance

There are various types of whole life insurance policies available, so it’s essential to understand the differences before deciding which one is right for you.

People interested in cash-value life insurance should buy participating policies, while seniors needing only small death benefits should purchase non-participating coverage.

Whether your contract is non-participating or participating depends on if you receive any dividends.

- Non-participating policies do not pay any dividends and therefore offer lower premiums.

- Participating Policies pay tax-free dividends that can be applied to your whole-life policies premiums or cash value.

Individuals interested in investment-style policies should always purchase a more expensive participating policy from a mutual insurance company.

Mutual companies will outperform the competition because the policyholders receive dividends as part owners of the company.Mutual insurance companies offer various dividend options that can positively affect the performance of your policy over time.

We suggest purchasing paid-up additions with your dividends that add to the value of your original coverage and increase the cash value over time.

Variations of Whole Life Insurance

- Guaranteed Issue – Your acceptance is guaranteed with these non-participating policies that often cover final expenses.

- Indexed – Your cash value’s interest rate relies on how an investment index such as the S&P 500 performs.

- Single Payment – A single premium whole life policy is fully funded with only one sizeable payment, and coverage lasts your entire lifetime.

- Limited Payment – A limited pay whole-life policy is paid up in a shorter time frame with more expensive premiums.

- Modified Whole Life Insurance – Charges a lower premium for initial savings, then increases rates after two to three years.

- Reduced Paid-up – If you do not need as much coverage, you can use your cash value to buy a smaller paid-up whole-life policy.

- Simplified Issue – Offers small death benefits with no cash value; only a few medical questions are required for approval.

- Survivorship Life – Second-to-die policies are used in estate planning and insure two people under one policy and payout after you both die.

- Variable Life – You select cash value investments offered by your insurance company, and your account accumulates interest based on the performance of your investments.

Best Whole Life Insurance Companies

Best Whole Life Insurance Companies

Evaluating the top whole life insurance companies will depend on whether you want cash accumulation or just death benefit protection.

Which whole-life companies pay dividends?

Several highly-rated mutual companies offer participating policies that pay dividends directly to policyholders.

New York Life and Northwestern Mutual are terrific companies with quality whole-life policies.

But, New York Life and Northwestern Mutual are both captive companies, so their agents can only sell their life insurance policies compared to a broker representing various insurers.

Highly rated companies like MassMutual and Penn Mutual are committed to selling independently through insurance brokers.

Penn Mutual

We love Penn Mutual as our choice for someone looking for a policy with dividends or a substantial death benefit.

Penn Mutual often underwrites policies up to $7,500,000 death benefits with no medical examination required.

Penn Mutual’s Guaranteed Choice whole life offers many flexible payment options, from limited-pay life to longer duration products that are paid up at age 65 or 100.

Penn Mutual is one of the best-performing whole life insurance policies because of its cash value performance and an industry-leading dividend rate of 5.75% in 2022.

The Penn Mutual Life Insurance Company was voted Investopedia’s best whole life insurance company for dividends in 2023.

We would happily integrate the best dividend-paying whole life insurance policy into your other wealth-building endeavors.

To maximize Penn Mutual’s cash value performance, you will want to ask your agent about overfunding your policy or the infinite banking concept.

What are the best whole-life companies for final expenses?

A popular and predictable way to cover your last expenses is with non-participating whole-life insurance.

These policies offer smaller death benefits and are not for people looking for cash values or a sizeable permanent policy to protect their estate.

Transamerica, Mutual of Omaha, Gerber, and AIG are our favorite choices for final expense coverage.

Transamerica Life

Transamerica also has several whole-life products for the final expense market, with coverage amounts ranging from $1,000 to $50,000.

These policies are more expensive and do not require a medical exam.

The Immediate Solution is a traditional final expense policy with coverage up to $50,000, requiring lifetime payments.

With the Easy Solution, you can purchase up to a $25,000 death benefit, but If you die in the first two years, you will not get the full face value, except for accidental death.

Transamerica’s whole life insurance is best for seniors and individuals with pre-existing medical conditions.

Mutual of Omaha

Mutual of Omaha

Mutual of Omaha is a well-known insurer with an A+ rating from A.M. Best.

The Living Promise is a non-participating whole-life policy with coverage up to a $40,000 death benefit.

The Living Promise is one of best selling whole life insurance policies for seniors because only a telephone interview is required for approval.

United of Omaha offers inexpensive permanent life insurance for smokers because they do not have a separate tobacco classification.

Plus, if you do not qualify for full benefits coverage, you are still eligible for their graded death benefit, which is limited to only $20,000.

Gerber Life

Gerber Life

Gerber is a baby food company that sells small final expense policies with no health questions to answer, so you are automatically approved!

Because there are no health questions, there is a two-year waiting period before a death benefit will be paid to your beneficiaries.

This guaranteed issue policy offers expensive coverage of up to $25,000 and is only recommended for people with high-risk medical conditions.

AIG FINAL EXPENSE INSURANCE

Corebridge Financial, previously known as AIG, sells cheap burial insurance to seniors through agents and on its website.

With AIG Senior Life, people between the ages of 50-80 are guaranteed acceptance without answering health questions or taking a medical exam.

AIG guaranteed issue whole life ranges between $5,000-$25,000 death benefits.

Why Buy Whole Life Insurance

Why Buy Whole Life Insurance

Unlike term life insurance, whole life insurance covers you for your entire life, not just for a set number of years.

This makes it worth considering if you want to ensure your loved ones are taken care of regardless of when you die.

In addition to the death benefit payout, you can access the tax-deferred cash value through policy loans or withdrawals.

Some mutual companies offer non-direct recognition policies that always credit you the same dividend even when you have borrowed against your policy.

So long as a small death benefit remains when you die, no income tax is charged on any prior withdrawals and loans.

You should always speak with one of our financial advisors to see if this coverage makes sense for you and your long-term goals.

Deciding whether or not to buy whole-life coverage is a big financial commitment. Many factors, such as age, health, and lifestyle, play into its affordability.

However, getting quotes from different insurers using our life insurance calculator is one way to make the decision easier.

Ultimately, the decision is up to you, but getting quotes is an excellent way to find the best policy for your needs at a price that fits your budget.

Trending Life Insurance Topic

-

Affordable Life USA offers comprehensive life insurance solutions to families and business owners throughout the United States.

Our founder, Eric Van Haaften, developed his passion for quantitative analysis while earning his business degree from Ferris State University, which laid a strong foundation for his analytical approach to financial planning.

Eric has obtained a professional LUTCF designation, awarded by the National Association of Insurance and Financial Advisors and the American College of Financial Services.

Another professional accolade is qualifying for the prestigious Million Dollar Round Table. Eric also serves as the treasurer of the Senior Sing Along charity.

Eric Van Haaften, LUTCF

-

Affordable Life USA

2524 Woodmeadow Grand Rapids, MI 49546 . 1-877-249-1358

What Is Whole Life Insurance?

What Is Whole Life Insurance? WHOLE LIFE VS. UNIVERSAL LIFE

WHOLE LIFE VS. UNIVERSAL LIFE Whole Life Insurance Calculator

Whole Life Insurance Calculator Pros and Cons of Whole Life Insurance

Pros and Cons of Whole Life Insurance Types Of Whole Life Insurance

Types Of Whole Life Insurance Best Whole Life Insurance Companies

Best Whole Life Insurance Companies Mutual of Omaha

Mutual of Omaha Gerber Life

Gerber Life

Why Buy Whole Life Insurance

Why Buy Whole Life Insurance