Are you feeling stuck trying to choose between IUL vs. whole life insurance coverage? If so, then you have come to the right place!

We will compare whole life vs indexed universal life policies, their benefits, and drawbacks, and suggest when each type may suit different needs.

Join us as we navigate the intricacies and differences between IUL and whole life to help you make the right decision.

Quick Navigation Links

- IUL vs. whole life insurance

- What is whole life Insurance?

- What are the pros and cons of whole life insurance?

- How does indexed universal life work?

- What are the pros and cons of IUL insurance?

- How to use permanent life insurance as an investment?

- What permanent insurance riders are available?

- Which is better, whole life or IUL?

IUL vs Whole Life

IUL vs Whole Life

Choosing the perfect life insurance policy can be overwhelming with all the available options.

The coverage possibilities seem endless, from budget-friendly term life insurance to high-end permanent policies such as variable universal life.

However, when it comes to permanent coverage, two popular choices stand out: whole life insurance and index universal life insurance (IUL).

Before making a commitment that will last a lifetime, it’s crucial to consider your individual needs carefully.

Whole Life Insurance Explained

Whole Life Insurance Explained

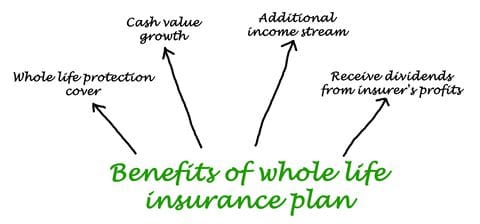

Whole life insurance offers lifetime protection, tax-deferred cash values, and the potential to earn annual dividends.

If you’re interested in receiving dividends from your policy, choose a participating policy from a mutual insurer with a strong track record of paying dividends.

It’s good to know that the cash value inside whole-life policies can be borrowed against or withdrawn by the policyholder when required.

Whether you need extra money for emergencies or additional income during retirement, you can access the accumulated cash value through withdrawals or policy loans.

Remember that if you die while still owing on a loan taken against your policy, the loan will be subtracted from the death benefit paid out to your heirs.

Pros and Cons of Whole Life Insurance

Pros and Cons of Whole Life Insurance

Whole life insurance can be a beneficial choice for those looking to secure their loved ones, both now and in the future.

It’s important to understand the pros and cons of whole life insurance so that you have all the information needed to make a sound decision.

⊕

advantages of whole life insurance

- Guaranteed benefit: With a whole life insurance policy, your beneficiaries are guaranteed to receive a payout upon your death.

- Minimum interest rate: Whole-life policies typically offer a minimum interest rate on the cash value component, ensuring it grows over time.

- PolicyAcees: You can borrow against the cash value or withdraw from your policy if needed.

- Tax-free growth: The cash value within a whole life policy grows tax-deferred, meaning you won’t owe taxes on any gains until you withdraw them.

- Simple design: Whole life insurance policies are straightforward and easier to comprehend compared to other types of insurance products

- Steady premiums: Unlike term life insurance, where premiums increase with age, whole life premiums remain constant throughout the policy.

- Annual dividends: Some whole-life policies may pay out annual dividends based on company performance, providing an additional source of income for policyholders.

⊕

Disadvantages of whole life insurance

- Lower rates: Compared to other investment options, such as stocks or mutual funds, the interest rates offered by whole-life policies tend to be lower.

- Expensive: Whole life insurance tends to have higher premium costs than term or universal policies due to its lifelong coverage and a built-in savings component.

- Less flexible: Once you’ve purchased a whole life policy, making changes can be more challenging than other types of life insurance.

Exploring Indexed Universal Life Insurance

Exploring Indexed Universal Life Insurance

Let’s delve into indexed universal life and explore what differentiates it from other permanent coverage options.

IUL insurance provides lifetime coverage while helping you build tax-advantaged savings without the typical market risks associated with traditional investments.

The beauty of IUL lies in its flexibility. Unlike traditional whole-life plans, you have some control over how much premium goes towards death benefits and how much builds up in your cash value account.

⊕

Who should buy iul insurance?

People buy IUL coverage for immediate death benefit protection and for its valuable cash reserves that can be accessed through loans or withdrawals sometime in the future.

But be aware IULs come with risks. Market fluctuations can impact your returns, leading to varying investment results. While some years may bring substantial growth, others may yield no gains.

If you enjoy taking measured financial risks, an IUL policy could be the perfect fit.

⊕

How IUL Insurance Works

Indexed universal life allows you to allocate a portion of your premiums towards a cash account linked to market indices like the S&P 500.

Insurance companies use options contracts and establish cap rates, floors, and participation rates to determine how much interest is earned.

- Cap rate: The cap rate sets a maximum limit on the amount of interest you can earn. They are typically ranging from 10% to 14%. This means that even if the index performs exceptionally well, your earnings will never exceed the specified cap rate.

- Floor rate: On the other hand, the floor rate establishes a minimum level of interest that can be earned. This is usually set at 0%, ensuring that even in case of a significant decline in the index’s value, you won’t lose any money but wouldn’t earn any additional interest.

- Participation rate: The participation rate indicates what portion of index gains you receive. Most policies have a participation rate of 100%, meaning you would receive all gains up to your cap rate.

Compare the Cost of IUL Vs Whole Life

- Select Duration

- Select Amount

- Press Get Quote

Pros and Cons of IUL Insurance

Pros and Cons of IUL Insurance

Evaluating the benefits and drawbacks before making any financial planning decision is important, according to Investopedia.

Let’s see if investing in an IUL policy should be considered part of your overall financial strategy.

⊕

Advantages of indexed universal life insurance

- Higher rates: Due to its structure and investment options tied to market indexes, IUL policies may offer the potential for accelerated cash value growth compared to whole life insurance.

- Policy access: Policyholders can take out loans against the policy’s cash value or make withdrawals, providing flexibility and financial support when needed.

- Tax-free growth: The cash value of an IUL policy typically grows without incurring taxes, allowing for potential tax savings over time.

- Flexibility: Policyholders can adjust their premium payments according to changing financial circumstances, offering greater control and adaptability.

- Inexpensive: Indexed universal life policies generally require lower premium payments compared to traditional whole-life policies, making them more affordable for many individuals.

⊕

disadvantages of indexed universal life

- Policy risk: Depending on various factors, such as policy performance and market conditions, there is a possibility that the death benefit could be reduced or even lost entirely.

- Unpredictable returns: Understanding how an IUL policy works can be challenging due to its intricate design and reliance on market index performance, which can fluctuate unpredictably over time.

Investing With IUl vs. Whole Life

Investing With IUl vs. Whole Life

Don’t just view life insurance as something that pays out after you die; consider the possibility of it being a retirement-income vehicle.

Many people with disposable income use whole life and IUL policies for their cash accumulation potential.

Is whole life or IUL better than a 401(k) plan for retirement income?

Not really. Permanent coverage is purchased for its death benefit, while its cash values can be used as a supplement to your existing retirement plans.

So, if you want to maximize your investment potential beyond traditional IRAs and 401(k) ‘s, consider utilizing your life insurance policy as an investment.

Learn more about the exciting possibilities of using permanent insurance as an investment by reading our informative article on life insurance retirement plans (LIRP).

Alternatively, explore the Infinite Banking Concept, an innovative strategy for rich people to leverage indexed or whole life insurance for efficient wealth-building.

Best Iul and Whole Life Insurance Companies

Ensure you do your due diligence when selecting an insurer for your indexed universal or whole life insurance policy.

Affordable Life USA monitors a network of many of America’s best IUL and whole life insurance companies.

Companies leading the pack for indexed universal life include American National, Mutual of Omaha, Lincoln Financial, and Pacific Life.

If you prefer whole life, we recommend mutual insurers that make dividend payments to policyholders like MassMutual and Penn Mutual.

Take a step towards securing your financial future by getting a permanent life insurance policy today!

Whole Life and IUL Insurance Riders

Whole Life and IUL Insurance Riders

IUL and whole life have optional riders that can provide additional benefits to your coverage.

Remember, while these riders offer valuable benefits, assess your needs and budget before adding them to your policy.

- Accelerated Death Benefit Rider: This rider allows policyholders diagnosed with terminal illnesses to access their death benefits early.

- Waiver of Premium Rider: If you become disabled and cannot work, this rider will waive your premium payments.

- Long-Term Care Rider: With this rider, you can cover potential expenses related to long-term care in case you need it.

- Income Protection Rider: This rider ensures that you have a steady income stream during periods of disability or inability to work due to unforeseen circumstances.

If you are unsure which rider is the right fit for you, don’t hesitate to seek advice from one of our insurance professionals.

Which is Better, Whole Life or IUL?

Which is Better, Whole Life or IUL?

So, you’ve navigated the maze of IUL vs. whole-life insurance and understand that both are permanent policies that provide coverage for your entire lifetime.

Whole life is stable, predictable, traditional, and safe – like a cozy blanket for your financial future.

Indexed Universal Life is modern and flexible, but be cautious of market fluctuations – it’s like riding a wave with your money.

Riders? Absolutely! Both offer optional extras at an additional cost – it’s like customizing your insurance policy with an extra treat on top.

And let’s not forget their secondary roles as retirement-income vehicles – they can help you build cash value for the future.

However, remember that they shouldn’t replace dedicated retirement savings plans such as IRAs or 401(k)s. Don’t put all your eggs in one insurance basket!

The decision between IUL vs. whole life depends on your financial goals and tolerance for risk – it’s like choosing between a safe bet and an exciting adventure.

Affordable Life USA is here to assist you if you’re unsure or need personalized guidance tailored to your needs.

-

Affordable Life USA offers comprehensive life insurance solutions to families and business owners throughout the United States.

Our founder, Eric Van Haaften, developed his passion for quantitative analysis while earning his business degree from Ferris State University, which laid a strong foundation for his analytical approach to financial planning.

Eric has obtained a professional LUTCF designation, awarded by the National Association of Insurance and Financial Advisors and the American College of Financial Services.

Another professional accolade is qualifying for the prestigious Million Dollar Round Table. Eric also serves as the treasurer of the Senior Sing Along charity.

Eric Van Haaften, LUTCF

-

Affordable Life USA

2524 Woodmeadow Grand Rapids, MI 49546 . 1-877-249-1358

IUL vs Whole Life

IUL vs Whole Life Whole Life Insurance Explained

Whole Life Insurance Explained Pros and Cons of Whole Life Insurance

Pros and Cons of Whole Life Insurance Exploring Indexed Universal Life Insurance

Exploring Indexed Universal Life Insurance Pros and Cons of IUL Insurance

Pros and Cons of IUL Insurance Investing With IUl vs. Whole Life

Investing With IUl vs. Whole Life  Whole Life and IUL Insurance

Whole Life and IUL Insurance Which is Better, Whole Life or IUL?

Which is Better, Whole Life or IUL?