Take the first step towards buying life insurance by understanding the difference between term life vs. whole life insurance.

We will explore the specifics of term life insurance and discover the advantages of choosing whole-life coverage.

If you are looking for information on cost differences between these two types of life insurance, we have got you covered!

Quick Navigation Links

Understanding Term Life Insurance

Understanding Term Life Insurance

We suggest locking in term rates when you are healthy, even if it’s longer than your anticipated needs for protection.

Whole Life Insurance Explained

Whole Life Insurance Explained

Whole life insurance is a type of permanent life insurance that provides coverage for your entire lifetime as long as you pay the premiums on time.

Whole-life policies generally have higher premiums because they offer cash values and the potential to earn annual dividends.

If you want an insurance policy with dividends, purchase a participating policy from a mutual insurance company with a solid dividend history.

Whole life insurance offers a significant perk: tapping into its accumulated cash value. Whether for emergencies or supplemental retirement income, policyholders can withdraw funds or take out loans against this value.

However, it’s crucial to remember that any outstanding loan balance at the time of the policyholder’s death will reduce the death benefit amount their beneficiaries receive.

⊕

Using WHOLE LIFE INSURANCE AS AN INVESTMENT

Are you looking to maximize your investment potential beyond traditional IRAs and 401(k) ‘s? Consider utilizing your whole life insurance policy as an investment.

Whole life policies ensure steady returns via cash value growth and dividends, serving as a dependable strategy for long-term wealth accumulation.

Learn more about the exciting possibilities of using whole life insurance as an investment by reading our informative article on life insurance retirement plans (LIRP).

Alternatively, explore the Infinite Banking Concept, an innovative strategy that leverages indexed universal or whole life insurance for efficient wealth-building.

Selecting Whole Life or Term Life

The primary objective of any life insurance policy is to offer financial protection for your loved ones in the event of a tragedy.

The death benefit is a safety net, ensuring they can maintain their lifestyle without financial difficulties.

Here, we will explore both term vs. whole life insurance pros and cons so that you can select the right insurance for your needs and budget.

⊕

When to buy Term Life Insurance

If you have a tight budget, a term life policy is the least expensive way to cover your family.

Term life insurance does not build up any savings, but it offers a high level of coverage for a lower premium than whole-life insurance.

It is suitable for people with a large and urgent need for protection, such as paying off a mortgage or supporting dependents.

Financial gurus Suze Orman and Dave Ramsey agree that term coverage reigns supreme in the term vs. whole life insurance debate because most people only need coverage for a limited time.

When selecting a policy, ensure you opt for a term length that aligns with your expected protection needs to guarantee adequate coverage.

- Cover Debts: You have specific debts, like a mortgage, that you want to ensure are covered during your death.

- Children: You have kids and want to guarantee that their college tuition expenses will be covered if you die prematurely.

- Income Protection: You only need life insurance to protect your income for a certain period, such as until you retire.

⊕

When to choose Whole-Life insurance

Whole-life insurance offers lifelong support but has higher premiums due to its cash value component and indefinite coverage.

If you have adequate income to support the premium payments, there are several common reasons why you might need whole life insurance.

- Cash Value Accumulation: To build cash value that can be used as a savings vehicle that grows tax-deferred and can be accessed while living.

- Lifetime Dependants: To provide lifelong support to dependents, such as a non-working spouse or a child with special needs.

- Estate Planning: Whole life is a good option if you need funds for estate taxes or desire additional inheritance for loved ones after your passing.

- Final Expenses: Permanent coverage will ensure enough money is available for funeral expenses regardless of when you pass away.

Whether you opt for whole life or term life, ensure that it aligns with your budget and long-term goals to provide your loved ones the necessary protection and peace of mind.

Regardless of which policy you choose, remember to stay current with premium payments; otherwise, you risk losing all the benefits of your life insurance policy.

Cost of Term Life vs. Whole Life

To determine which life insurance policy is the best choice, comparing rates can be a great place to start.

If you want to get started with some initial life insurance quotes, use our calculator to compare rates from top-rated insurance companies.

The cost of each option will depend on various factors like your age, gender, health, and the amount of coverage you need.

It’s important to mention that your quotes may require customization based on your health and individual needs.

For further assistance and a personalized proposal, please don’t hesitate to contact us at 877-249-1358 or fill out the provided form. Begin your life insurance journey today!

Term vs. Whole Life Insurance Calculator

- Select Duration

- Select Amount

- Press Get Quote

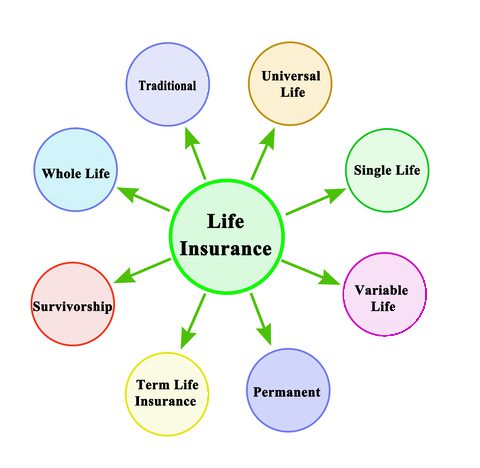

The Universal Life Insurance Alternative

Universal life insurance is emerging as a popular choice for those seeking a balance between term and whole-life policies.

This option provides the flexibility to modify payments and coverage according to financial changes without the expiration constraints of term insurance plans.

Moreover, guaranteed universal life can be economically designed to focus on enduring coverage rather than the automatic cash value accumulation associated with whole-life plans.

This adaptability makes it an attractive alternative for individuals looking to customize their insurance strategy to fit specific personal needs.

Deciding between term life insurance and permanent options, such as whole or universal life, requires expert advice. If you have any questions, we are happy to help!

FAQ: Term and Whole Life Insurance

FAQ: Term and Whole Life Insurance

Is term insurance cheaper than whole-life insurance? Term coverage is more affordable because it provides temporary coverage, unlike whole life insurance, which offers permanent protection and builds cash value.

Can you own term and whole life insurance at the same time? You can simultaneously have term and whole life insurance policies using a layering strategy. This method combines different policy types to suit your changing needs at various stages of your life.

Which is better, whole life or term life insurance? Choosing between term and whole life insurance hinges on your needs. Term life is inexpensive, catering to short-term requirements, but lacks permanence or cash value accumulation. Conversely, whole-life policies suit long-term planning with lifelong coverage and cash value growth, albeit at a higher cost.

Should you buy term and invest the difference? This approach entails purchasing a cheap term policy and investing the savings from not buying a pricier whole-life policy. To execute this strategy, you must allocate the difference in premiums towards investments that yield higher returns than your policy.

Can you convert the term into whole life insurance? You can convert the term into a more expensive whole-life policy without health inquiries. It is necessary to convert within the specified timeframe outlined in your policy. Before executing this transition, ensure you will need lifetime coverage and can afford the premiums.

Trending Life Insurance Topics

-

Affordable Life USA is a leading independent insurance agency offering comprehensive life insurance solutions to clients nationwide.

Our founder, Eric Van Haaften, brings over 35 years of experience in catering to the life insurance needs of successful individuals and business owners.

Mr. Van Haaften has been featured in prestigious outlets such as Time, Newsweek, US News, and The Wall Street Journal.

Our skilled team of insurance agents and financial planners is committed to securing the ideal coverage that fits your requirements and budget.

Start your search using our insurance calculator to explore quotes from many highly-rated life insurance companies.

Affordable Life USA, LLC

Eric Van Haaften, LUTCF

1-877-249-1358

Whole Life Insurance Explained

Whole Life Insurance Explained

FAQ: Term and Whole Life Insurance

FAQ: Term and Whole Life Insurance