Navigating the world of life insurance can be challenging. But don’t worry, we are going to demystify your choices by comparing term versus permanent life insurance.

Our comprehensive guide will investigate the differences between term and permanent life insurance, outlining each plan’s advantages, functionality, and pricing.

By breaking down the complexities, we’ll help you find the best type of policy for your family’s needs and budget.

Quick Navigation Links

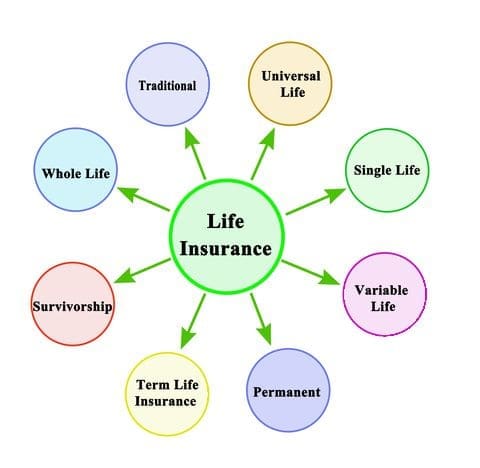

Unraveling the Basics of Life Insurance

At its essence, life insurance provides financial support to your family in the event of your passing, covering essential expenses like funeral costs, ongoing mortgage payments, or even funding your children’s education.

There are term policies that provide coverage for a specified period and permanent policies that offer lifelong protection alongside savings opportunities.

For those seeking added peace of mind, there are various living benefit riders available that can enhance your coverage under certain circumstances.

Whether you opt for a term or permanent life insurance, these riders can address needs such as long-term care costs, disability support, or managing chronic illnesses.

Let’s delve into the differences between term and permanent life insurance to help you select the ideal policy for your needs.

What is Term Life Insurance?

What is Term Life Insurance?

Term life insurance offers protection for a specific period, ranging from 10 to 40 years.

This type of insurance is economical for safeguarding your family’s financial future, covering expenses like mortgage payments, or replacing lost income.

Several term insurance options are available, each designed to cater to different needs and preferences.

- Level Term Life: This popular coverage option offers guaranteed death benefits and fixed premiums for a designated period.

- Annually Renewable: ART policies offer a constant death benefit but start with lower premiums that rise each year.

- Decreasing Term: With decreasing term coverage, death benefits decrease over a defined period with lower constant premiums.

- Convertible Term: These term policies allow policyholders to convert to permanent coverage without requiring medical underwriting.

- Return of Premium Term: ROP term guarantees that your premiums will be returned to you tax-free if you are still living at the end of the term period.

Which term plan is best?

Which term plan is best?

Most families opt for level-term life insurance due to its fixed premiums and assured death benefits during the term.

Among various options, a 10-year term policy is the most cost-effective solution, providing coverage for a decade before it expires.

Meanwhile, buying either a 20-year or a 30-year term insurance policy is more economical over the long term for those needing extended protection despite their higher costs.

It’s wise to lock in fixed-term rates while you are young and healthy, even if the duration exceeds your expected protection requirements.

If you live beyond the specified term, no payout will be made unless you decide to convert your term policy into permanent coverage.

It may be worth considering alternatives such as return-of-premium policies if you have reservations about traditional term coverage because it lacks a savings element.

What is Permanent Life Insurance?

What is Permanent Life Insurance?

Permanent life insurance is designed to cover your entire life, ensuring that your beneficiaries receive a death benefit as long as premiums are paid.

This type of policy is generally more costly than term life insurance but includes a cash value component.

This cash value grows tax-deferred and can be borrowed or withdrawn for various needs such as emergencies, educational costs, or retirement income supplementation.

Additionally, whole-life policies may offer dividends from the insurer’s profits, potentially increasing the policy’s cash value and death benefit.

Various forms of permanent life insurance are available, each offering distinct advantages tailored to different needs.

- Whole Life Insurance: Whole life provides permanent protection with fixed premiums, accumulating cash values, and dividends. Policy dividends can be used to enhance cash value, reduce your premiums, or be taken in cash.

- Indexed Universal Life: IUL offers lifelong coverage and allows for the accumulation of cash value over time. IULs provide a cash value linked to the performance of the S&P index or specific economic sectors.

- Guaranteed Universal Life: With universal life insurance, you receive lifelong coverage and a cash value component that earns a conservative fixed rate. You may also have the ability to adjust the death benefit amount.

- Variable Universal Life: Variable life provides a fixed premium, cash values, and a death benefit. VUL cash values are invested in sub-accounts that behave like mutual funds. So, your cash values can fluctuate based on the performance of the bond and stock market.

What’s the best permanent life insurance policy?

What’s the best permanent life insurance policy?

When deciding between whole and universal life insurance, it’s essential to consider their differences in flexibility and cost.

Both whole life and indexed universal life (IUL) suit those looking to build cash value within their policy.

Whole life insurance guarantees interest rates, whereas IUL insurance ties the cash value growth to an index or investment portfolio.

These permanent options come with higher price tags but have provisions for accessing the policy’s accrued cash value.

In times of emergency or to supplement retirement income, you can tap into this cash reserve through withdrawals or policy loans.

However, guaranteed universal life insurance offers a cheaper solution if your primary concern is ensuring lifelong coverage rather than building cash value.

Comparing Term vs. Permanent Life

Comparing Term vs. Permanent Life

Term and permanent life insurance are two different options you should consider carefully based on your financial goals, family situation, and budget.

Term life insurance may be more affordable and suitable for you if you only need coverage for a certain period of time, such as while raising your children or paying off your mortgage.

It can provide financial protection for your dependents in case of your death during that period, but it will expire after the term ends.

On the other hand, permanent life insurance generally involves higher fixed premiums, lifelong coverage, and cash value accumulation. This type of policy is ideal for those with disposable income who wish to leave a legacy for their heirs.

Whether opting for term, permanent, or a combination of both policies, the key is ensuring that you secure some level of coverage to safeguard your loved ones in case something unexpected happens.

Consulting with one of our knowledgeable insurance agents can help you navigate these options to determine the most suitable plan for your family’s needs.

Benefits of Term Life Insurance

- Cheaper: Term insurance costs less compared to permanent coverage and allows you to protect your loved ones without breaking the bank.

- Specific Needs: It allows you to allocate funds towards specific financial goals with a set timeline and ensures that your family can fulfill these obligations even if you’re no longer around.

- Income Protection: Term coverage is ideal for protecting your income for a certain period, such as until you retire.

- Temporary: It provides coverage for a specified period, allowing you to reassess your needs and budget at the end of the policy term.

- Convertible: It can be converted to permanent life insurance at the end of the term if you still need coverage.

Advantages of Permanent Life Insurance

Advantages of Permanent Life Insurance

- Lifetime Coverage: It provides lifelong coverage, regardless of when you die, as long as you pay the premiums.

- Cash Value: It builds cash value over time, which you can access while alive by withdrawing or borrowing from the policy.

- Estate Planning: It is an excellent choice if you want to leave behind a tax-free inheritance after you pass away.

- Funeral Expenses: Whole life policies guarantee that enough money will be available to cover funeral expenses, regardless of when you pass away.

Cost of Term vs. Permanent Life

Choosing the right life insurance plan can be tricky, especially when you have to consider the long-term financial impact of your decision.

You ultimately will need to decide whether term or permanent coverage suits your situation more effectively.

To help you compare the costs, we have created a free life insurance calculator that shows you the estimated premiums and benefits for each option.

Don’t wait any longer. Try it out today and see how much you can save on your life insurance!

Term Life vs. Permanent Life Rates

- Select Duration

- Select Amount

- Press Get Quote

FAQ: Term or Permanent Life Insurance

FAQ: Term or Permanent Life Insurance

Can you have term and permanent life insurance at the same time? Absolutely, it’s possible to hold both term and permanent life insurance policies simultaneously. This approach, known as a laddering strategy, blends various policy types to adapt to your evolving needs and objectives throughout life.

What happens at the end of term life insurance? If you outlive your term, you can either renew it annually, which may lead to higher premiums yearly, or convert it into a permanent plan. Although more costly, converting offers lifelong coverage and the opportunity to accumulate cash value over time.

Why is term life insurance cheaper than permanent coverage? Term insurance is more affordable as it offers temporary coverage, unlike permanent insurance which provides lifelong protection and accumulates cash value.

Should you buy only term insurance and invest the rest? This strategy involves buying a cheaper term policy and investing the money saved from not purchasing a more expensive permanent policy. By opting for term coverage, you secure more protection at a lower cost and can allocate the difference in premiums towards investments potentially yielding higher returns.

Can you cash out a permanent life insurance policy? Certainly! If you decide to cash out your life insurance policy, the amount you’ll get is based on its cash surrender value. This is the remaining balance after deducting any fees or penalties. Remember that withdrawing funds during the surrender period could lead to charges, and any earned interest will be taxable.

Trending Life Insurance Topics

-

Affordable Life USA offers comprehensive life insurance solutions to families and business owners throughout the United States.

Our founder, Eric Van Haaften, developed his passion for quantitative analysis while earning his business degree from Ferris State University, which laid a strong foundation for his analytical approach to financial planning.

Eric has obtained a professional LUTCF designation, awarded by the National Association of Insurance and Financial Advisors and the American College of Financial Services.

Another professional accolade is qualifying for the prestigious Million Dollar Round Table. Eric also serves as the treasurer of the Senior Sing Along charity.

Eric Van Haaften, LUTCF

-

Affordable Life USA

2524 Woodmeadow Grand Rapids, MI 49546 . 1-877-249-1358

What is Term Life Insurance?

What is Term Life Insurance? Which term plan is best?

Which term plan is best? What is Permanent Life Insurance?

What is Permanent Life Insurance? What’s the best permanent life insurance policy?

What’s the best permanent life insurance policy? Comparing Term vs. Permanent Life

Comparing Term vs. Permanent Life  Advantages of Permanent Life Insurance

Advantages of Permanent Life Insurance FAQ: Term or Permanent Life Insurance

FAQ: Term or Permanent Life Insurance