When choosing a permanent life insurance policy, the debate often boils down to whole life vs universal life insurance.

This comprehensive guide will delve into the key features of whole life and universal life policies.

We will explore how each type of policy works, its benefits and drawbacks, and the factors affecting its pricing.

We’ll also explore the remarkable features of permanent life insurance, offering lifelong protection and the opportunity to build tax-free savings within your policy.

Prepare yourself for a secure and prosperous future by gaining a clear understanding of your insurance options.

Quick Navigation Links

Understanding Whole Life Insurance

Understanding Whole Life Insurance

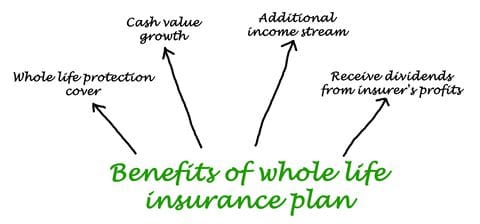

Whole life offers a guaranteed death benefit, and unlike other policies, your rates won’t increase as you age or due to health conditions.

Whole life insurance also lets you accumulate cash value on a tax-deferred basis. It’s like having a hidden reserve of cash that grows with time.Plus, Mutual insurers usually pay dividends to policyholders that can either be added to a cash value or used to help pay premiums.

Types of Whole Life

Several types of whole life insurance policies offer a range of options to meet different financial needs.

- Indexed: The interest rate on your cash value is determined by the performance of an investment index like the S&P 500.

- Variable Life: You can choose investments offered by your insurance company that will determine your account’s cash value growth based on their performance.

Most whole-life coverage is purchased because of its contractual guarantees and dividend potential.

If you want a policy with dividends, make sure to purchase a participating policy from a mutual insurance company with a solid dividend history.

However, people interested in smaller death benefits should buy non-participating policies that do not pay dividends and consequently offer lower premiums.

Pros and Cons of Whole Life Insurance

Let’s look at the benefits and drawbacks of choosing whole-life insurance to help you decide if it’s a good choice for your family.

⊕

Advantages of whole life

- Predictable Premiums: You pay the same amount forever. The premium amount for whole life insurance remains constant throughout the policy, making it easier to budget for future expenses.

- Tax-free Death Benefit: The death benefit that goes to your beneficiary when you die is not taxable.

- Tax-deferred Growth: The cash value account can offer a conservative interest rate.

- Tax-free Policy Loans: You can borrow against your policy’s cash value. Your policy loan can be paid back or subtracted from your death benefit.

Dividends: Whole life plans pay dividends that generally are not subject to income taxation.

⊕

Disadvantages of Whole Life Insurance

- Less Flexibility: You can’t easily adjust your premiums or death benefits.

- Expensive: Whole life is considered the most costly form of permanent life insurance.

- Lack of Investment Control: The insurer invests your premiums conservatively, not appealing to experienced investors.

Exploring Universal Life Insurance

Exploring Universal Life Insurance

On the other hand, if you prefer flexibility, a universal life insurance policy offers flexibility and the potential for cash value growth.

Universal life insurance is like a chameleon – it adapts to your financial situation.

You can adjust premiums, skip payments, and even use the cash value to take a break from paying altogether. Talk about flexibility.

Types of Universal Life Insurance

There are several kinds of universal life insurance policies that offer a spectrum of investment options within their cash value component.

- Indexed Universal Life Insurance: With IUL policies, the cash value growth is tied to an index such as the S&P 500. The policyholder can earn higher returns if the index performs well while still having downside protection if it declines.

- Variable Universal Life Insurance: This option allows you to invest your cash value in various investment accounts, such as stocks or bonds. The performance of these investments will determine the growth potential and cash value accumulation.

- No-Lapse Guarantee Universal Life Insurance: GUL policies ensure that coverage remains in force regardless of changes in interest rates or market conditions, provided that minimum premium payments are made on time.

People often purchase variable and indexed universal life insurance for tax-deferred growth during their lifetime and as a safeguard against untimely death.

The accumulated cash value can be used for various purposes, such as supplementing retirement income, funding educational expenses, or covering unexpected emergencies.

People only needing lifelong protection should purchase guaranteed universal life that has less emphasis on cash value accumulation.

Wealthy people also buy GUL coverage for its superior return on investment upon death and often use life insurance as an asset to provide tax-efficient wealth transfer or pay estate taxes.

Pros and Cons of Universal Life Insurance

Are you trying to decide if universal life insurance is the right fit for your financial strategy?

Universal life insurance provides flexibility and security far beyond what traditional whole-life plans can offer.

But, as with any financial decision, there’s a lot to consider before signing up. So, let’s explore the advantages and weaknesses of choosing universal-life insurance.

⊕

Advantages of Universal Life

- Affordable: Universal life death benefits can be guaranteed for a lifetime and is the cheapest form of permanent life insurance.

- Flexible-Premium Payments: Universal life insurance allows policyholders flexibility in choosing how much they want to pay their monthly premiums.

- Potential Cash Value Growth: Similar to whole life policies, universal life accumulates cash value that can grow over time.

- Tax-free Policy Loans: You can borrow against your universal life policy’s cash value.

⊕

Disadvantages of Universal Life

- Interest Rate Risk: The cash value growth in a universal life policy is tied to prevailing interest rates. If interest rates decline, the cash value accumulation may not meet expectations and could affect policy performance.

- Complexity: Universal life insurance policies can be complex and require active management to ensure the policy remains in force and meets your financial goals.

Compare Whole vs Universal Life Costs

- Select Duration

- Select Amount

- Press Get Quote

Whole vs. Universal Life Cash Values

Whole vs. Universal Life Cash Values

When comparing the difference between whole life and universal life policies, it is important to consider the financial implications.

While both types offer long-term protection, they differ in flexibility and affordability.

⊕

IUL vs. whole life Cash Value

The cash value component is the most crucial factor when choosing between whole life vs indexed universal life insurance.

Both types of permanent life insurance offer tax-deferred cash values, but they differ in terms of interest rates.

Whole life insurance policies provide fixed interest rates. They are like a steady turtle, slow but predictable.

While variable universal, indexed universal and adjustable life insurance offers greater flexibility in premium payments and interest rates based on market conditions.

Unlike whole-life policies that guarantee cash value returns, universal life coverage returns tend to fluctuate depending on prevailing market conditions.

This means there is potential for higher gains during favorable economic periods and a risk involved if the economy performs poorly, leading to lower-than-expected returns.

⊕

BORROWING MONEY FROM CASH VALUES

Borrowing money from your universal or whole-life cash values is a great way to access quick cash.

However, building a substantial cash value is a slow process and can take many years before you can take a policy loan out against your policy.

When you borrow from a universal or whole-life policy, your cash values are utilized as collateral on the loan.

So, when you borrow against your life insurance policy, the outstanding loan does not interrupt the compounding interest inside your policy.

Interest rates on policy loans are normally lower than bank loans because insurers can easily take the collateral if you do not make payments.

If you die with an unpaid policy loan, insurers will reduce the death benefit by your outstanding loan amount.

Furthermore, when you die, insurance companies will keep your cash values if you do not take them out before your death.

⊕

Permanent life Insurance as an investment

Are you looking for a new investment option after maxing out your IRA or 401(k)? Consider using your permanent life insurance policy as an investment alternative!

While the investment component of whole life insurance grows at a moderate fixed rate, it can still be a wise decision to utilize this strategy.

If you want to learn more about using whole life insurance as an investment, check out our article on life insurance retirement plans (LIRP).

For those interested in a different approach, you might want to consider the Infinite Banking System, which utilizes indexed universal or whole life insurance.

Learn how to start making the most with your money with new indexed- universal, or whole life insurance policy today!

Cost of Whole Life vs. Universal Life

Cost of Whole Life vs. Universal Life

Generally, universal life insurance tends to have more affordable premiums than whole life insurance.

Why is whole life more expensive than universal life?

This is primarily because whole life insurance offers more guarantees. It ensures a specific death benefit, a fixed premium, and a certain growth rate on the cash value.

While these guarantees provide stability and predictability, they also have a higher price tag, according to Investopedia.

On the other hand, universal life insurance allows for more flexibility to adjust your payments and decrease your coverage based on your financial situation.

Additionally, universal life policies can be structured to prioritize lifetime protection rather than accumulating cash value.

Factors such as age, health condition, lifestyle habits (such as smoking), and occupational risks influence the cost of both policies.

However, it’s important to note that whole life insurance requires a consistent commitment which may become burdensome during challenging times.

Whether you’re considering term life insurance or permanent insurance, like whole or universal life, consulting an insurance pro is a must.

No two individuals have the same insurance needs; therefore, it is important to take an individualized approach when selecting a policy.

We can help you navigate the complexities and find the best fit for your needs.

Trending Permanent Insurance Topics

-

Affordable Life USA offers comprehensive life insurance solutions to families and business owners throughout the United States.

Our founder, Eric Van Haaften, developed his passion for quantitative analysis while earning his business degree from Ferris State University, which laid a strong foundation for his analytical approach to financial planning.

Eric has obtained a professional LUTCF designation, awarded by the National Association of Insurance and Financial Advisors and the American College of Financial Services.

Another professional accolade is qualifying for the prestigious Million Dollar Round Table. Eric also serves as the treasurer of the Senior Sing Along charity.

Eric Van Haaften, LUTCF

-

Affordable Life USA

2524 Woodmeadow Grand Rapids, MI 49546 . 1-877-249-1358

Understanding Whole Life Insurance

Understanding Whole Life Insurance Exploring Universal Life Insurance

Exploring Universal Life Insurance Whole vs. Universal Life Cash Values

Whole vs. Universal Life Cash Values Cost of Whole Life vs. Universal Life

Cost of Whole Life vs. Universal Life